Our latest quarterly Mobile Trade-In and Upgrade Industry Trends Report is now available, offering valuable insights into the secondary device market.

Here are three highlights from our Q3 report:

- Trade-In Programs Hit a New High: Over $1 billion was returned to consumers in Q3 2024, marking the first time this has been reached in the third quarter.

- 5G Devices Lead the Way: For the first time, 5G-enabled devices were the top turned-in models from trade-in and upgrade programs for both Android and Apple.

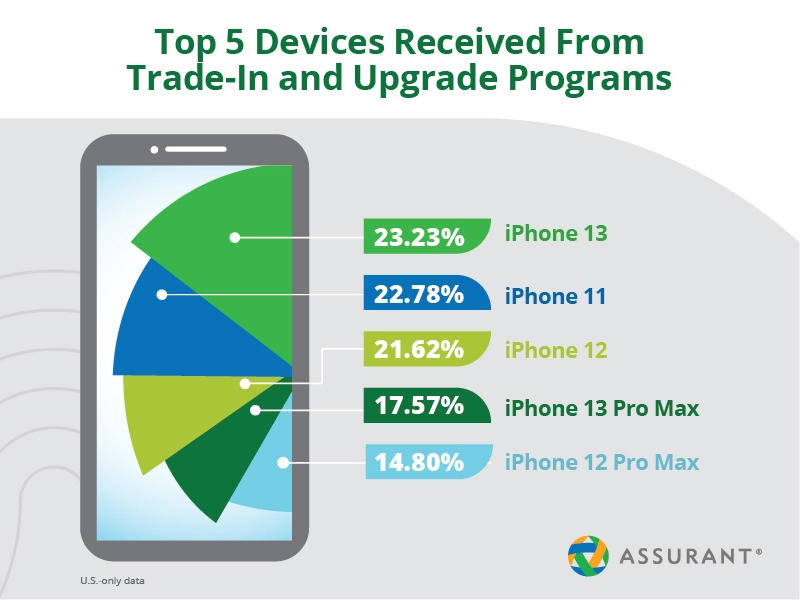

- iPhone 13 Takes the Top Spot: The iPhone 13 became the most turned-in device, surpassing the iPhone 11 and iPhone 12.

Let’s dive into the results.

5G Devices Dominate Trade-Ins

This past quarter saw a significant shift with 5G devices leading the charts. The iPhone 13 emerged as the most turned-in device, accounting for 23.2% of the top five turned-in devices. This marks a change from the iPhone 11, which held the top spot for nine consecutive quarters, and the iPhone 12, which was second for four quarters.

On the Android side, the Galaxy S22 Ultra 5G overtook the Galaxy S21 as the most turned-in device. The S21 had been the leader for the past five quarters.

A New Milestone for the Third Quarter

Though we’ve seen over a billion dollars returned to U.S. consumers through trade-in programs during busy fourth quarter seasons, this is the first time we’ve experienced it in a third quarter. $1.092B was received by consumers in this past quarter. With the appeal of new devices featuring capabilities such as AI, consumers are trading in newer, 5G-enabled devices and benefiting from their higher value. This, in turn, increases the availability of high-connectivity devices for secondary market consumers.

Want to learn more about the mobile device trade-in trends for Q3

Check out our latest quarterly infographic.

Trends in Device Age

The average age of devices turned in decreased for the first time in 2024. The average age of iPhones at turn-in is now 3.69 years, while Android devices average 3.38 years. This decrease could indicate that consumers are upgrading to newer models more frequently, perhaps driven by the appeal of advanced features in 5G devices.

Overall, these trade-in and upgrade programs not only enhance affordability by reducing device costs, but also generate additional revenue for operators, OEMs, MSOs, and retailers. The other benefactor from trade-in is the environment as these devices are kept out of landfills, and there’s a reduction in carbon emissions through the reuse of pre-owned devices.

See more in our Q3 2024 Infographic.